Strangle

Description

The

Strangle is a simple adjustment to the Straddle to make it a little cheaper.

Instead

of buying at-the-money options, you buy out-of-the-money calls and puts, which

creates a lower cost basis and therefore potentially higher returns. The risk

you run with a Strangle is that the break evens can be pushed further apart,

which is bad, but where the difference is not too great then the Strangle can

be fantastic.

You

simply buy lower strike puts and higher strike calls with the same expiration

date so that you can profit from the stock soaring up or dropping down. As with

the Straddle, each leg of the trade has limited downside (i.e., the call or put

premium) but uncapped upside.

Again,

the same challenges apply regarding Bid/Ask Spreads and the psychology of the

actual trade. Remember that time decay hurts long options positions because

options are like wasting assets. The closer you get to expiration, the less

time value there is in the option. Time decay accelerates exponentially during

the last month before expiration, so you do not want to hold onto options into

the last month.

Market

Opinion

Direction

neutral.

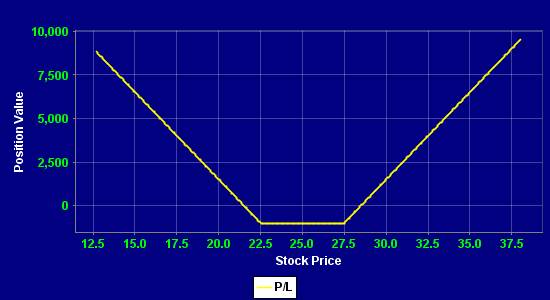

P/L

When

To Use

Use

this capital gain strategy when you anticipate greatly increasing volatility in

the price of the stock, in either direction.

Example

XXXX

is trading at $25.37 on May 14, 2011.

Buy

August 2011 $22.50 strike put for $0.85.

Buy

August 2011 $27.50 strike call for $1.40

Net

debit: premiums bought = $2.25

Benefit

The

benefit is the possibility of unlimited profit from a volatile stock moving in

either direction, with capped risk, and less expensive than doing a Straddle.

Risk

vs. Reward

The

risk is limited to the net debit of the puts and calls you bought. The reward

is unlimited.

Net

Upside

Unlimited.

Net

Downside

Net

debit paid.

Break

Even Point

Break

even up: higher strike plus net debit

Break

even down: lower strike minus net debit

Effect

Of Volatility

Positive,

especially between the strike prices.

Effect

Of Time Decay

Negative.

Time decay also accelerates the fastest in the last month.

Alternatives

Before Expiration

Try

not to hold in the last month as time decay accelerates then.

If

the stock drops significantly, sell the put to make a profit and wait for

retracement to profit from your call.

If

the stock rises significantly, sell the call to make a profit and wait for a

retracement to profit from the put.

Always

close the trade out after a news event occurs when there is no movement in the

stock.

Alternatives

After Expiration

Close

out the position by selling your puts and calls.